Bitcoins are a virtual currency that has propelled to the forefront in the last 5 years. Its volatile nature is still debatable, but the future of digital currency seems luminous as days pass.

Acceptance has grown vastly as some companies pay their employees in Bitcoins. Quite a number of retailers now allow cryptocurrency payments proving that the adoption rate of virtual currency is tenacious.

The Internal Revenue Service (IRS) recently clarified the regulation procedure of taxing cryptocurrency. Their previous attempt in 2014 left many questions unanswered, to the bewilderment of the public. The clumsiness of the revenue department in overseeing the virtual tax rulebook was noteworthy.

They had misunderstood the brainwork and complexity of the blockchain system, leaving out critical technicalities for users who made their virtual income through mining, donations, trading, and conversion.

For all the late bloomers there are 3 informative steps

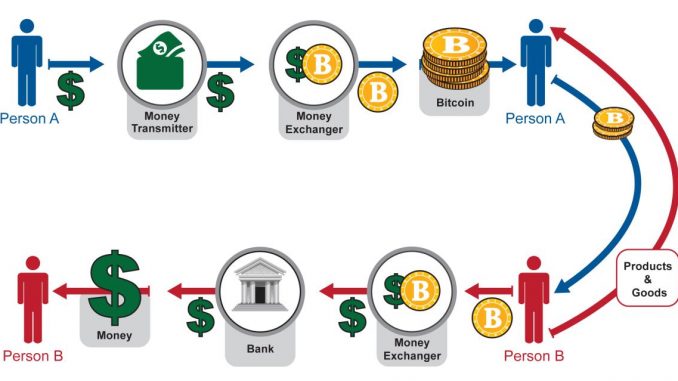

How virtual currency works

When bitcoins are purchased, the coin itself is not in one’s possession instead, a password that can access the unique coin is obtained. Every single bitcoin is a combination of a public and private key.

The public key is an address containing a location where the coins are collected and stored. The private key is the password that unlocks the front door of the location gaining access to the virtual currency.

The keys are linked mathematically and cannot be opened if misaligned with other private keys. Much like a digital signature, that can verify the holder of the account.

Read here to know more about Bitcoin Tax.

How value is determined

Bitcoins will always have a ground value of zero. The volatility that comes with it is from the people who believe it to have value and push towards its acceptance as a new medium of exchange.

Changes in expectations, the angst of people against its development and unwelcoming of its presence is reflected in its inconsistent value.

How virtual currency is stored

The private key is your most secure virtual device. If anyone gains access to this key, control to your bitcoins is inevitable.

Each private key consists of 64 characters. Mainly stored in Bitcoin wallets online or on a computer’s hard drive. If misplaced will result in the funds lost forever as it cannot be duplicated.

Even on a hard drive, it can still be hacked, or your computer may crash. Printing out the 64 characters on a piece of paper isn’t the way either as the paper will have to be kept in a secluded spot.

One popular method which many bitcoin users adopt is digital wallets. Electronic wallets store private keys on the user’s behalf securely. Traditional means like a username and password are used as entry identification point to access information inside the wallet.

Its main selling point, if one forgets or misplaces their password or username, the service provider of said e-wallet can reset it for you.

Local wallets are ones that are stored on a computer or external hard drive. Complete control is given to the user, but it can only be accessed from that user’s device. Hence, if your personal security is top-notch this might be the one for you.

Hardware wallets consist of USB sticks or thumb drives oftentimes not more than the size of one’s palm. They are installed with an encryption structure and some form of WPA2 or higher security. This is a good immune way to protect your bitcoins though, a good hardware wallet will cost top dollar.

Online wallets are popular because they can be accessed remotely. Sites like Coinbase or Blockchain.info provide wallets to their users stored on their platforms. This raises few concerns of skepticism as online wallet sites contain a lump sum of cryptocurrency from its user base that could make it a target for hackers as the payoff for them might make it feasible in their eyes.

The second one is, the user is halfway between his/her funds because of the continuous intervention of the e-wallet service provider.

2019 is round 2 at rewriting the virtual tax rulebook. With the inclusion of most scenarios that were unaddressed 5 years ago.

Let’s break it down

In the form of payment from an employer

Bitcoins can be used to pay for products or services, from employers to employees as a mode of payment. However, the employer must include in his/her’s earnings in the report filed to the IRS on W-2 forms.

The Bitcoin value must be converted to the U.S. dollar, as is the value of the date of each payment reflected in the maintained records. These virtual wages are subject to withholding to the same extent as the wage of the U.S. dollar.

Self-employed virtual currency holders must include gains or losses from all sales transactions and convert the Bitcoins into the dollar rate from the specific date of payment.

In the form of an asset

If the Bitcoins possessed are held as a capital asset then, they are subject to be treated as property. As applicable, property taxes do apply once the conversion is done. Any profit or losses from the asset is taxed as capital gains or losses. This is done because the trader realizes only ordinary profit or losses on the exchange.

In the form of mining

For all the traders that mine Bitcoins, the IRS states, ‘when a taxpayer successfully “mines” Bitcoin and has earnings from that activity whether in the form of Bitcoin or any other form, he or she must include it in his gross income after determining the fair market dollar value of the virtual currency as of the day you received it.’

In other words, the Bitcoins mined must be listed on the filed tax report after conversion to the U.S. dollar.

Now, if the miner is self-employed then, the particular individual’s gross earnings are subtracted from the allowable tax deductions and are also subject to a self-employment tax.